In the context of buying a home, grasping your mortgage is crucial for formulating informed financial decisions. Numerous prospective homeowners find themselves overwhelmed by the various factors that go into calculating the true cost of a mortgage. It is essential to look beyond just the interest rate and monthly payment to comprehend the entire picture. By being aware of what to factor in, you can avoid common pitfalls and ensure that you are totally prepared for your financial commitments.

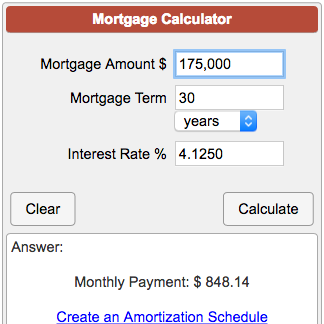

Using a mortgage calculator can be an essential tool in this process. It enables you to experiment with multiple loan amounts, interest rates, and terms to see how they influence your monthly payment and overall cost. However, a lot of individuals overlook key variables such as property taxes, insurance, and potential homeowner association fees. This article will walk you through the essential calculations and considerations to provide a more precise understanding of what your mortgage truly entails.

Grasping Home Loan Basics

If thinking about a mortgage, it is essential to grasp what a mortgage actually is. A mortgage is a debt exclusively used to buy property, where the real estate itself acts as guarantee. This means that if you do not to repay the loan, the lender has the authority to claim the assets via a method known as repossession. Mortgages typically have extended loan durations, typically spanning a range of 15-30 years, and are designed with various interest rates and repayment options.

One key component of mortgages is the initial sum and interest payments. The principal is the starting sum taken out, while the interest is the fee for borrowing. As you process periodic payments, part of your installment goes to diminishing the principal, and the remainder goes to interest. Grasping how these parts work in conjunction is vital for calculating your recurring dues and the total cost of your mortgage in the long run.

Another essential aspect is the idea of structured payment, which denotes the gradual reduction of your loan balance through planned payments. Most mortgages adhere to an amortization schedule, specifying how your payments will impact the principal and interest during the life of the loan. Using a mortgage calculator can help you explore various possibilities, allowing you to assess how changes in interest, loan terms, or down payments will influence your complete financial commitment.

Important Calculations for Your Home Loan

To grasp your actual mortgage costs, begin by determining your monthly principal and interest payments. This is typically done using a mortgage calculator, which needs inputs like the loan amount, interest rate, and loan term. By inputting these figures, you can ascertain how much you will owe each month, allowing you to plan accordingly. Knowing this amount is essential as it is the bulk of your monthly obligation.

Next, factor in property taxes and homeowner's insurance. These costs are usually included in your monthly mortgage payment through an escrow account. To get an exact monthly amount, calculate your annual property tax rate and homeowners insurance premium, then break down by twelve. This extra amount will ensure you are preparing for the complete financial obligation that comes with homeownership beyond just the principal and interest.

In conclusion, consider potential mortgage insurance premiums if your down payment is under 20 percent. HipoteCalc protects the lender in case of default and increases to your overall payment. Calculate this cost based on your specific loan scenario, and include it in your total monthly payment. Understanding all these components as a whole will provide a clearer picture of your real mortgage costs and help you organize your finances efficiently.

Common Mortgage Misconceptions Dispelled

Numerous people believe that a 20% deposit is a hard requirement for buying a home. This false belief can be deceptive, as various mortgage options are available that permit for lower down payments. Programs such as Federal Housing Administration loans allow buyers to put down as little as 3%, which makes homeownership more accessible for those who may not have significant savings. Understanding that there are other choices can expand your options when looking for a mortgage.

An additional common misconception is that a higher credit score guarantees the most favorable mortgage rates. While a strong credit score is important in securing favorable terms, lenders also consider factors such as DTI ratio and the type of loan. Even applicants with suboptimal scores can get competitive rates, especially if their overall financial picture is solid. It is important to focus on improving your financial health beyond just your credit score.

Finally, many think that the only cost associated with a mortgage is the monthly cost. In truth, homeownership includes a variety of expenses such as property taxes, insurance for homeowners, and maintenance expenses. These extra expenses can significantly impact your total monthly budget. Using a mortgage calculator can help you estimate these costs with precision and provide a clearer picture of what you will truly owe each month.